FAQ

What are the office hours?

Our staff is available from 7:30 a.m. to 4:30 p.m. Eastern Standard Time to assist you with any questions, concerns or issues you are having.

How is an application submitted?

A unit of trained professionals has been established specifically to meet your E&O APPLICATION needs. We have a variety of ways you can submit your applications (web, e-mail, fax and U.S. Mail). Please consult the underwriter of your account for more information.

If you have issues submitting the fillable applications on our website, you may need to download Adobe Reader. Visit http://get.adobe.com/reader in order to download it.

What is Errors & Omissions Coverage?

Errors and Omissions (E&O) insurance is a form of professional liability coverage designed to protect an insured against allegations of mistakes made while performing the duties associated with his/her business. The policy includes coverage for both defense costs (e.g., attorney fees, court costs, etc.) and settlements or judgments. Intentional wrongdoing is specifically excluded.

What is prior acts coverage?

Most professional liability claims-made policies offer optional coverage for services performed prior to the effective date of the policy. This is called prior acts coverage. Prior acts coverage is typically extended to the effective date of a firm’s first claims-made policy (when claims-made coverage has been maintained continuously) or to some date that your firm and the insurance company agree upon for pricing or underwriting reasons. The date established is called the prior acts date or retroactive date. Generally, the date remains the same with each subsequent renewal. If an act, error or omission happened before the prior acts date, it will not be eligible for coverage. With prior acts coverage, you can move your coverage from one insurance company to another without losing protection for covered services you performed in the past.

What is the difference between a claims-made policy and an occurrence policy?

Coverage is activated when a claim is made (claims-made policy) instead of when a wrongful act occurs (occurrence policy).

What triggers coverage on a claims-made policy?

- Claim must be made during the policy period.

- Claim must be reported during the policy period.

– Most policies allow a 30 to 60 day period after policy expiration in which you can still report claims made during the policy period—check your policy for specific provisions.

- The wrongful act must occur on or after the policy retroactive date

What is a retroactive date?

Date from which you can show continuous proof of E&O coverage

• There may be NO gaps in coverage–not even 1 day

Why is a retroactive date important to maintain?

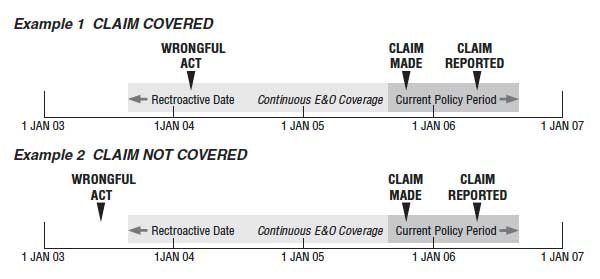

• In order for a claim to be covered, it must occur on or after the retroactive date. See Example 1 below.

• Any claim made prior to the retroactive date, will NOT be covered. See Example 2 below.

How can you pay?

- Installments are available in quarterly payments to Life and Health Agents only

- Outside financing quotes are available for all other product lines

- Pay in full

- Monthly payments are not an available option

How do you pay as sub producer?

- Installments are not available on sub-produced accounts

- Sub producing agents will be billed, not the insured directly